I imported wine for this time, but I don’t understand the process. At which point, I’m worried about what went wrong? Don't know what qualifications are needed? Do not understand what costs are incurred? Next, the editor will list the links of the first wine import and related knowledge points and precautions for you.

1. What is the process of importing wine for the first time?

1. First of all, when determining the amount and quantity of imported red wine, sign a contract with the foreign supplier (negotiate various terms such as contract trade terms, if you don’t understand, you can also call our company for specific related terms, we can provide related stencil)

2. International transportation

Shipping and air transportation are generally available. The import of red wine generally chooses sea transportation, which has low transportation cost. If high-quality wine is also available, you can also choose a constant temperature cabinet, which is generally at 15-18°C.

3. Payment of foreign exchange

Generally, most suppliers require a deposit to be paid before shipment, and the balance will be paid after arrival in Hong Kong. This involves payment of foreign exchange, and our company can also provide foreign exchange payment agents.

4. Filing before arrival

The consignee and consignor must be filed before arriving at the port of destination. Generally, it can be completed within 2 working days; in addition to the consignee and consignor, a label must be filed. Some ports must be completed before arrival, and some ports are only after arrival. Do label filing, so this must confirm the import port with us in advance, so as not to affect the customs clearance time

5. Customs declaration and inspection after arrival

Prepare all the customs clearance materials in advance, our company can start to declare after arriving at the port

6. Pay tax and verify tax

After the customs declaration, the tax bill will be issued, the tax will be paid, and the customs will verify the tax

7. Customs inspection

8. Supervision warehouse

The cabinet is pulled from the dock to the supervision warehouse, labeled in Chinese, sampled and tested, and issued a sanitary certificate

9. Release and delivery

2. So what are the requirements for the qualification of the importing company when importing wine for the first time?

1. To do import and export trade, you must first have import and export rights

2. Red wine belongs to the food category, and the business license needs to have pre-packaged food or wine items

3. Food circulation license

Sandal advantage: our company has a full set of red wine import qualifications, and can act as an agent for foreign exchange payment, transportation, customs clearance and other services

3. What information do I need to provide for wine import?

Some importers let the foreign direct shipments without confirming the information, resulting in insufficient time to prepare the information or lack of certain information, so that the customs clearance cannot be carried out smoothly, resulting in unnecessary costs, so be sure to confirm with us before shipping Documents and information issues, the following is the relevant information for imported wine

1. Information provided by foreign suppliers (château)

a. Packing list (PACKING LIST)

b. Invoice (INVOICE)

c. Contract (CONTRACT)

d. Bill of lading (BILL OF LADING, B/L)

f. Health certificate (HEALTHY CERTICATE)

g. Free for sale certificate (FREE FOR SALES)

h. Certificate of Origin (CERTIFICATE OF ORIGIN)

i. Composition analysis report (ANALYSE REPORT)

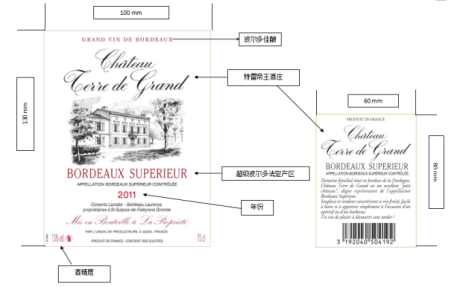

J. Original label proof (TABLE)

2. Information provided by domestic importers

a. Translation of composition analysis report

b. Label translations and design proofs

c. Importer's record information

4. What are the costs of importing wine for the first time? How much is the tariff?

1. The composition of all costs for the first import:

a, the value of red wine

b. Shipping costs from the winery to the domestic port + maritime insurance

c. Customs clearance fees

d. Tax

f. Domestic transportation costs

2. What is the import tariff for wine?

The main wine import countries are: France, Australia, Chile, Georgia, South Africa, Spain, Italy, New Zealand, Argentina

Most-favoured-nation wine import tariffs: 14% tariff, 13% value-added tax, and 10% consumption tax

Among them, Chile, Georgia, New Zealand, Australia and China have signed free trade agreements and enjoy tariff preferences

Australia, Chile, Georgia, New Zealand: customs duty 0%, value-added tax 13%, consumption tax 10%

Except for the 4 countries in the free trade agreement, the tariffs of imported red wine from other countries follow the most-favored-nation tax rate

5. What qualifications does the importer need to have when importing wine for the first time?

1. Import and export rights

2. Food circulation license or alcohol business license

6. What issues should be paid attention to when importing wine for the first time?

1. Qualification issues, we must first confirm the import qualification issues with our company before importing

2. Prepare the documents before the goods arrive at the port, so as not to delay the customs clearance time and incur additional costs

3. Do a good job of Chinese label translation and design before arrival

4. Confirm the destination port information with our company before shipment