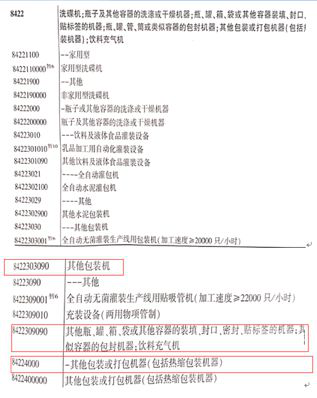

Everyone knows that packaging equipment should be classified into item 8422. The tax number of the Import and Export Practical Manual contains multiple "other packaging machines" and "encapsulation machines", so many importers are confused. I don't know how to classify these taxes. What is the difference between the numbers? Here is a brief summary and analysis for everyone.

First look at the list structure of heading 8422.

84.22

Dishwashing machines; washing or drying machines for bottles and other containers; machines for filling, sealing, sealing, and labeling bottles, cans, boxes, bags or other containers; machines for packaging bottles, cans, tubes, tubes or similar containers; others Packaging or packaging machines (including shrink packaging machines); beverage inflators (+):

— Dishwasher:

11 —Household type

19 —- Other

20 — Bottle or other container washing or drying machine

30 — Bottles, cans, boxes, bags or other containers filling, sealing, sealing, labeling machines; packaging machines for bottles, cans, tubes, tubes or similar containers; beverage inflators

Machinery for filling, closing, sealing, or labelling bottles, cans, boxes, bags or other containers; machinery for capsuling bottles, jars, tubes and similar containers; machinery for aerating beverages

40 — Other packaging or packaging machines (including shrink packaging machines)

Other packing or wrapping machinery (including heat-shrink wrapping machinery)

According to our daily understanding, the packaging machine is also the packaging machinery, but from the English catalog notes, the word "packing" only appears in tariff 8422.40. Isn't there no packaging machine in 8422.3?

Let's take a look at what packaging is and the definition of packaging: "Packaging is the general name of containers, materials, and auxiliary materials used in certain technical methods to protect products during the circulation process, facilitate storage and transportation, and promote sales; also Refers to the operational activities of applying certain technical methods in the process of using containers, materials and auxiliary materials in order to achieve the above-mentioned purposes.” Therefore, referring to the definition of packaging, the structure of the list, and the tariff book, the tariff 8422.3 "other packaging machines" The description of the word can have, not a typo, because these are all activities of packaging.

Then let’s understand what a "encapsulation machine" is. From the perspective of the tariff rules, it should belong to capsuling machinery. According to the item description, it belongs to a device for packaging containers, such as encapsulating bottles in plastic packaging. Moreover, the packaging of this product is different from filling, sealing, and sealing.

What is the difference between the tariff 8422.40 and the so-called "other packaging machines" of 8422.30? Since 8422.30 includes equipment that can be packaged, 8422.30 belongs to equipment packaged in "bottles, cans, boxes, bags, or other containers". Except for containers, it is recommended to be classified under tax code 8422.40.